Table of contents

No headings in the article.

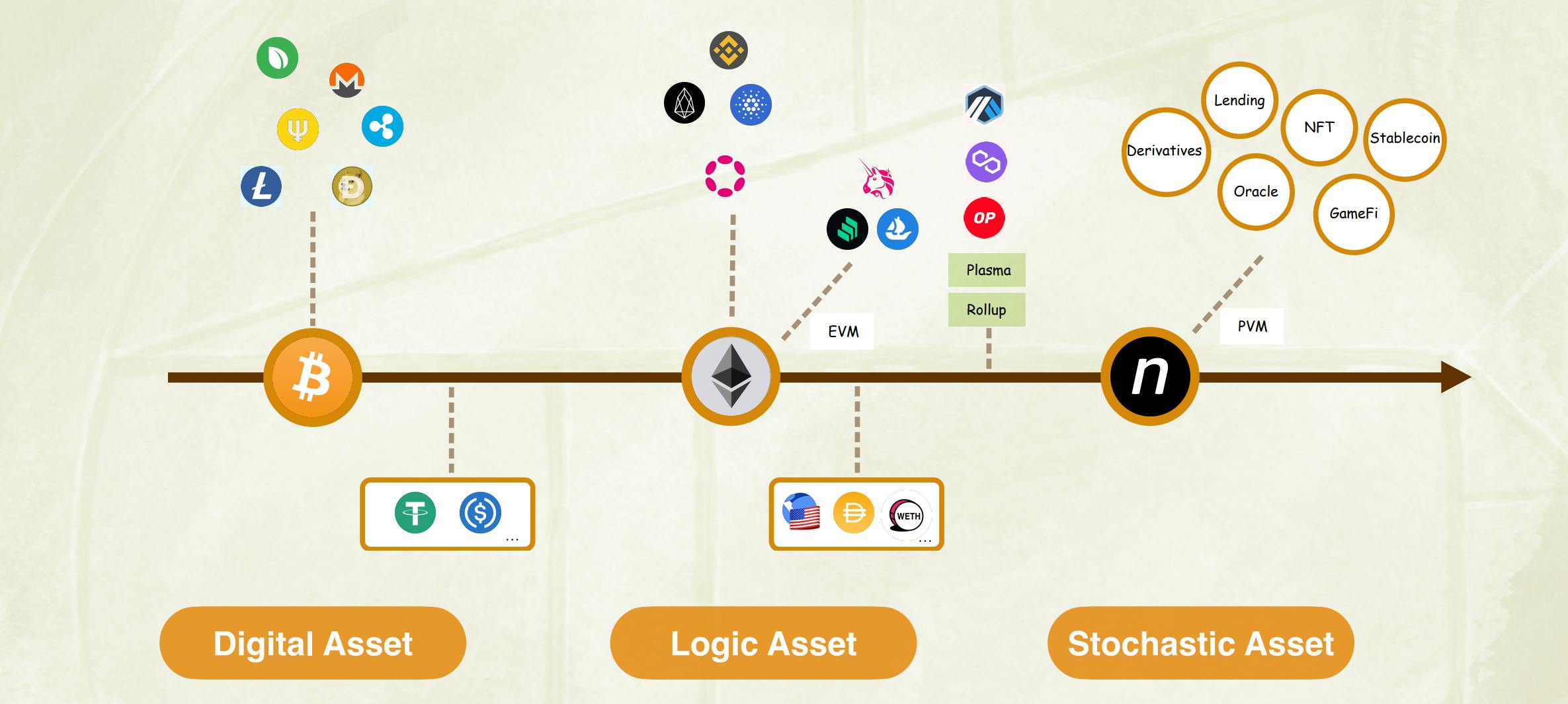

I'm sure many of you are familiar with the EVM. An Ethereum Virtual Machine (EVM) is a computational platform that allows developers to create decentralised applications (DApps) on Ethereum. This new software platform makes it easier for developers to operate smart contracts. EVM and smart contracts are helpful to some extent, because anyone can construct a DApp using the EVM.

But the EVM system is not completely decentralized, might be costly, and cannot have stochastic things.

Benefits of the EVM or Ethereum or smart contract

For EVM, firstly, it is open source, so anyone can build a DApp using EVM. And there are many possible use cases for this type of software.

Secondly, there are many potential advantages to using smart contracts. One notable example is non-forgeable tokens (NFTs). Anyone can make digital art or any virtual object and sell it on the NFT marketplace by registering an NFT account. Previously unattainable access to the art world is now made feasible through the use of EVM.

For smart contract, there’s no middleman required, and as it is written in advance, the code is the rules, and cannot be changed by human. This also helps in avoiding manual errors. There are also multiple backups in the blockchain network, so people do not need to worry about losing the data record. Last but not least, no trust and real personal information required to fulfil agreements.

Drawbacks of the Ethereum Virtual Machine

Unfortunately, there’s quite a lot drawbacks of EVM, and that’s why many new blockchains have arise to replace Ethereum, like Solana.

One of the biggest issues is its high gas fee. When the network is congested, the cost of gas goes up. For Ethereum users, this can be a serious drawback. While large transactions may not be affected much, everyone trying to submit small transactions may not be able to use the network for a short period of time because of this problem. Decentralised applications, in particular, are affected. When the price of gas grows too fast, and a large number of users engage in smart contracts, and create a large number of transactions, things may slow down and stop altogether.

In addition, from my point of view, the EVM system is not fully decentralised. Virtual machines like Amazon Web Services host the vast majority of Ethernet nodes. If they don't like it, the operators of these services may simply shut down their nodes, causing damage or disrupting the network. With some social media applications, this has happened before.

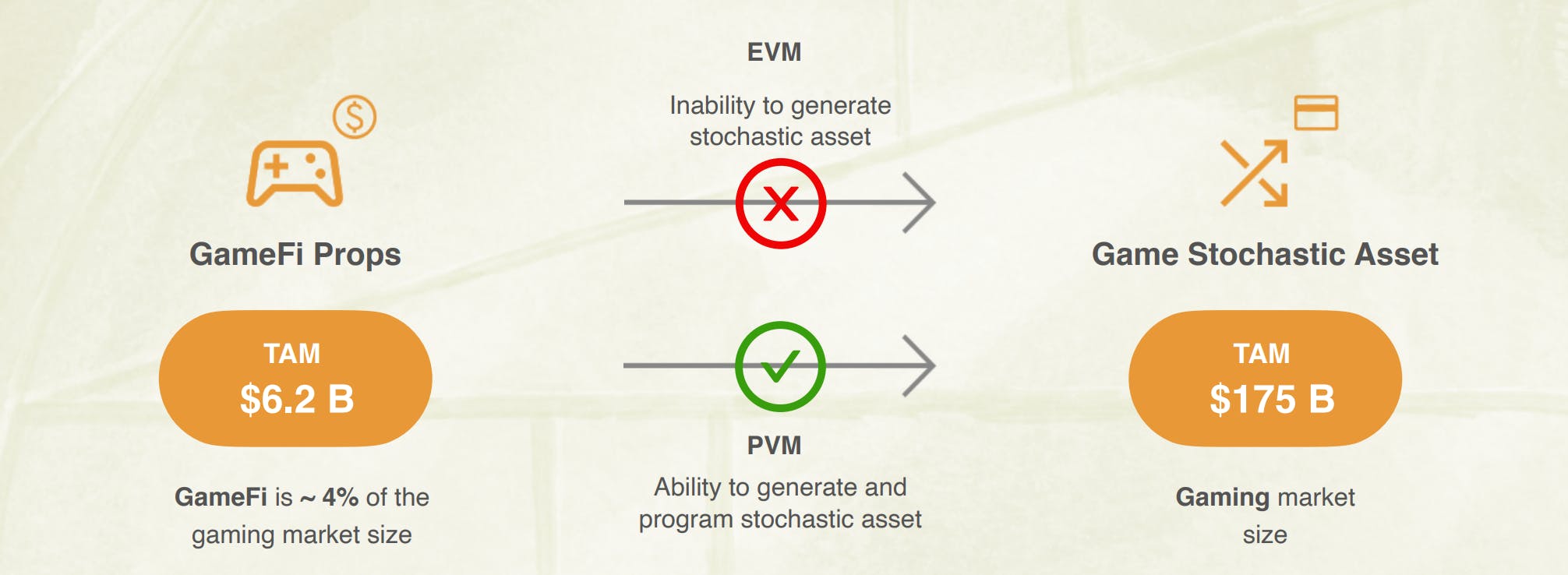

What’s more, the smart contracts lead to determined outcomes. However, the world is not deterministic, like the return of a financial product. For these investments, generating similar stochastic outcome is the key to manage risks, but EVM cannot help in doing that. That’s why Probabilistic Virtual Machine(PVM) emerges.

What is NEST PVM?

PVM (Probabilistic Virtual Machine) is a class of virtual machine structures based on a library of basic functions that allow a developer to assemble as many applications and various stochastic assets as he wants - similar to EVM programming.

NEST is not just a simple replica of Ethereum. Compared to Ethereum, PVM is able to provide the computation of random variables in the complete probability space. Any risk-return pair can be expressed exactly within PVM. This means that PVM has a larger development space than EVM. Participants can get various tokenized return distributions from PVM by paying gas fees with NEST. This will greatly simplify the development process of many products, where the original complex logic is reduced to a function transformation of random variables. Further, because all developers on NEST follow the unified standard of PVM, this provides great convenience for interoperability and integration among projects, which is extremely important for the development of the whole ecology.

What does PVM solve?

As a simple example, you bet your friend that tomorrow you will give her $1 if it is sunny and earn $1 from your friend if it is raining. This would be difficult to achieve on Ethereum. But this rule can be programmed in PVM, so it turns the random information into an asset, and here, the asset is NEST token. Then through the Omnipotence Market Maker, NEST will release the token to the users. PVM introduces random assets, so it can be used in GameFi, NFT, DeFi and many other areas.

Simply speaking, the probability virtual machine is a smart contracts generator. It is an idea that to bring probability distributions to the smart contracts so the settlements of the contracts can have more stochastic outcomes. So this is a tokenization of random information to generate assets.

NEST inherits Ethereum's genes. The essence of EVM is that each program is a combination of some base code that can be invoked by paying a certain amount of gas. The revenue of each product on PVM can be seen as a linear combination of some base revenue functions that can be obtained by paying a certain cost (i.e., the discounted value of this revenue). PVM’s underlying logic is identical to that of EVM, which means that all EVM development can be implemented on PVM.

Dive into the world of DeFi apps, integrations, and developer tooling built on top of the NEST Protocol. Please visit the NEST developers→ nestprotocol.org/developers